You do not need a plugin to set up your Woocommerce store for India GST rates. Here are the steps to set up India GST Rates on your Woocommerce store.

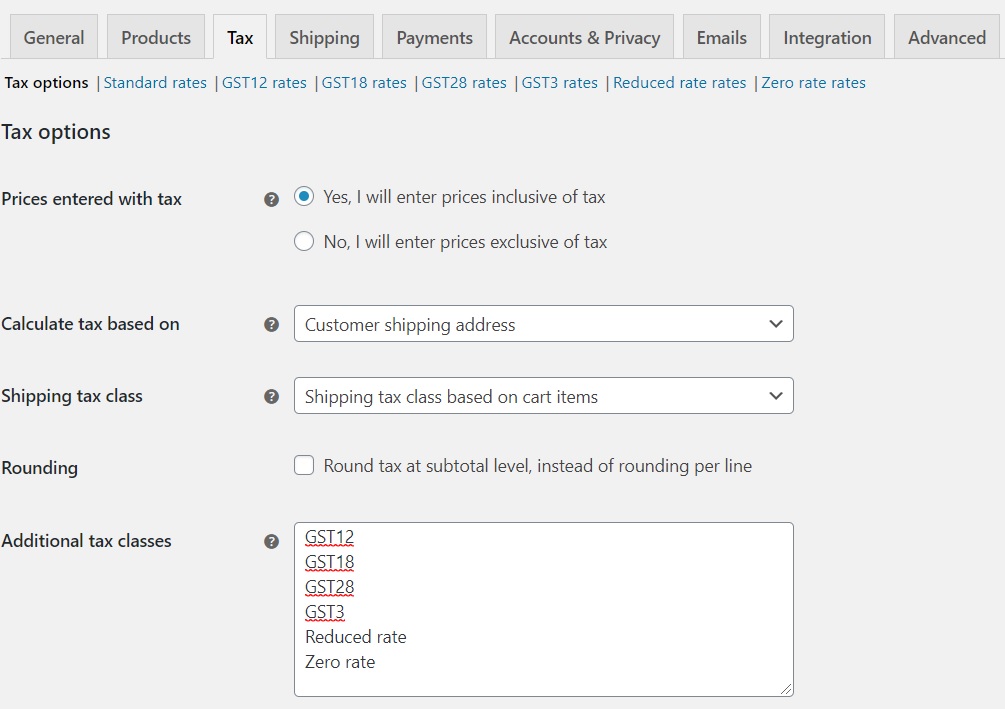

First set up your tax classes. You can name them anything. In this example, I have named then GST3, GST12, GST18 etc. Based on what you are selling on your Woocommerce store, you can use the Standard rate for the more prevalent GST rate for your products on your site. For example, in this example, I have used the 5% GST rate as Standard rate and have not created a separate class for that.

Once you save these tax classes, these will be available for you to update with appropriate tax rates (see Tax options links under the Woocommerce settings tab).

Also in the Calculate tax based on field, select Customer shipping address.

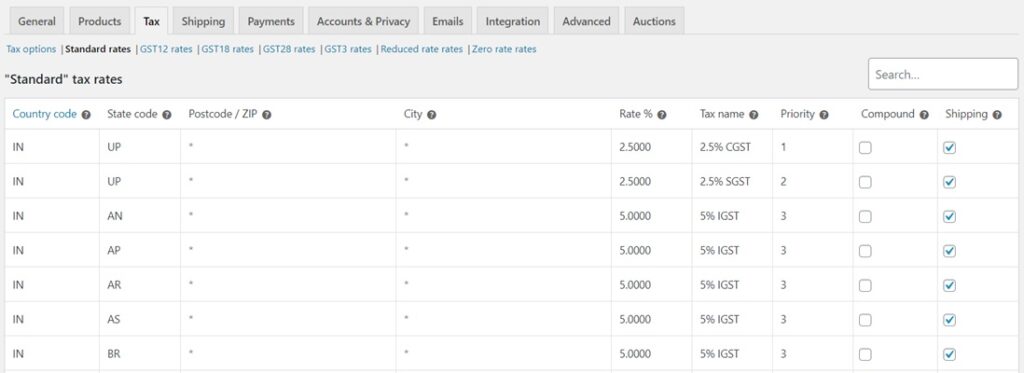

Next you need to update the tax rates. GST is applicable based on states. If you are shipping within the same state, you need to charge SGST and CGST. If you are shipping across states, you need to charge IGST.

For this, update your States and appropriate GST rates applicable. In this example, I have assumed that the home state of your store is Uttar Pradesh (UP). In this case, when shipping to Uttar Pradesh, SGST and CGST needs to be charged. When shipping outside Uttar Pradesh, IGST needs to be charged. You can create various tax rates based on Country Code and State Code (and even Pincodes or City codes).

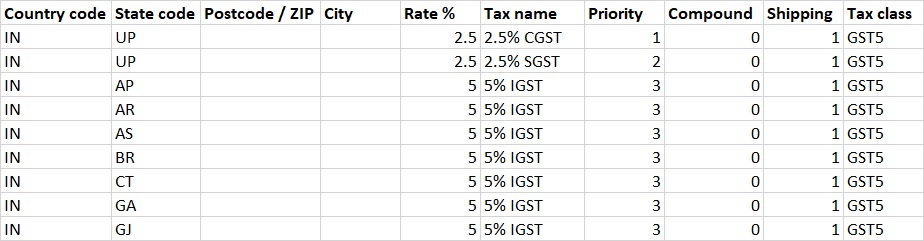

You can create a CSV file and upload the tax rates for all states. Points to remember:

- Priority is an important field. Woocommerce will apply only one rate for each priority list. So in this case, ensure that CGST and SGST and IGST have different priority numbers. And All IGST rates for all states should have the same priority number so only one of them is applied.

- In the example shown below, I have used Uttar Pradesh as home state. So if item is shipped to Uttar Pradesh, CGST and SGST is applied (priority 1 and 2) based on Country code and State code.

- Do not check Compound field.

- Check Shipping field so that the rate is applied to Shipping costs too. I believe that India GST is required to be applicable to shipping costs too.

Your CSV file can be structured as below:

You can download sample CSV file here: Sample CSV files for India GST Rates for Woocommerce

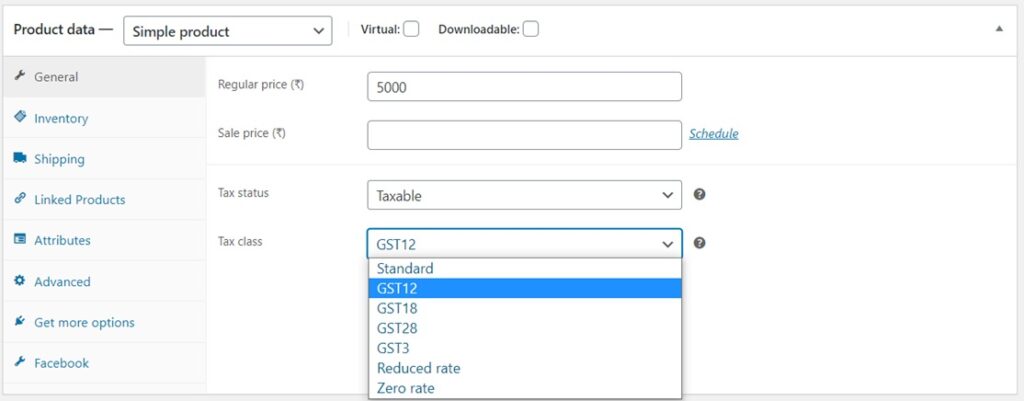

Finally, when you are adding products, select the correct GST rate applicable for that product.

Disclaimer: This is a technical perspective of setting up GST rates on your Woocommerce site. Please validate the correctness of what rates are applicable to your site with a Charted Accountant. Information provided in this blog post is provided in good faith with no guarantees of correctness about the Indian GST law.